Accounts payable software is a key part of operations for most small businesses. And automation in accounts payable can save you a lot of time. Read on to learn more.

To make regular daily tasks easier, small business owners and managers count on dedicated, efficient tools that organize their workflow. These can range from CRM software, business email clients, organizational chat tools and, of course, accounts payable software for small business.

The usual workday for a small business owner and manager is full of different tasks. Usually, it begins by delegating specific concerns to team members. Then, it includes client acquisition, resource management, marketing and other managerial tasks.

However, with the recent rise in office apps, there are ways to optimize and automate some of these tasks. This frees up time that you can use to grow your business and work on preferred fronts.

These apps range from office suites such as Google Workspace and email marketing tools to more bureaucratic parts of your business. They include banking apps, invoice generators, budget-controlling spreadsheets and, of course, accounts payable software.

Why do you need accounts payable software for small business?

Accounts payable is a corporate department that oversees all short-term debt a company has. Basically, invoices from vendors, contractor payments and overall balances which need to be taken care of.

That being said, this department usually exists only in bigger enterprises. Often, it ends up nonexistent in small businesses. This happens because the smaller companies don’t deal with multiple vendors and resources at a time, which cuts down on time spent organizing these payments.

However, that doesn’t mean accounts payable software for small business isn’t a necessary step. Given that this task is typically part of management duties, automating and organizing it is crucial to avoid mistakes.

Incidentally, these mistakes can be costlier for small businesses. For example, the business owner could forget to pay an invoice from their vendor and the fine can cause an unwanted debt. Or they can mismanage the payment date on bills and cause an account overdraft with their bank, which leads to interest.

In short, investing in accounts payable software for small business means less room for forgetfulness, disorganization and human errors. This translates to fewer financial worries and, as an added benefit, less time spent paying bills yourself.

The 4 most important features in accounts payable software for small business

It’s crucial to understand the dynamics of your company before picking any software. That is true for accounts payable as well. Since smaller businesses often have people putting on multiple hats, the apps need to work with it, not against it.

That is, your accounts payable software needs to be intuitive, flexible and cohesive. Then, you avoid having to switch between multiple apps to finish a task and context-switching. Instead, you can do it all directly from one place. Less time, fewer hurdles, top-notch efficiency.

Here are some features that can enhance your experience:

Vendor analytics

Part of the job of managing accounts payable software is keeping a good relationship with vendors. You should be paying your invoices on time, asking for quotes regularly and, of course, comparing them.

But it’s hard to follow up when all of your data is in different digital spaces. For instance, you have a spreadsheet outside the app to look for any price changes, upcharges and other relevant information. And need to check it before following up on a payment.

Additionally, if you constantly have to look up information on your vendors. Such as: which employees to talk to, where to pay, any specific discounts and trends, etc. That poses extra challenges and requires more data.

Some of the accounts payable software for small business options have vendor analytics. In short, these tools allow you to track your relationship with your vendors, previous purchases and payments and much more. That way, you can organize your payables and invoices accordingly and create an easier workflow.

This feature comes in handy in many industries, especially commerce. If you deal with restocking, for example, vendor analytics can help you track the frequency of your purchases. Then, you won’t be out of stock when a customer wants to buy from you.

Audit trail

Audits are a big worry for managers responsible for accounts payable, especially in small businesses. Since they are a part of running a business, an audit trail will keep your worries low. With automation in accounts payable audit trails, your software keeps track of what has been paid, when and how.

Then, if you or your accountant needs to confirm any data, it’s easier to find it and report it to tax authorities. Another benefit is that it cuts down on mistakes. The program checks for irregularities as it builds the audit trail. This raises important flags that you can take care of quickly. AKA, before they turn into more concerning situations.

Expense tracking

Another added point of accounts payable software for small business is that it helps you stay on track. Small businesses have smaller teams and often require managers to fulfil multiple roles. With that in mind, it’s harder to track every single aspect of your accounts.

But with buying supplies, paying contractors and organizing bills, you don’t want to go over your allocated budget. Nor end up in debt. So tracking expenses is a must.

If your accounts payable software tracks your expenses for you and offers reports, it’s much faster to go through and find a place you can save. Or how you can schedule your payments and purchases better to fit into your receivables.

Accounts payable automation

Automation is key for small business and automation in accounts payable is no exception. In fact, part of the concerns of small business managers and team members is that there isn’t enough time to finish all tasks. And with payments, which represent a big part of business, being late means causing a loss. Fines, overdrafts and missed payments can cut into the company’s budget, especially for a small business. Not to mention, the reputation concerns that this can develop into.

Picking an accounts payable software for small business that includes automating your payments is a game changer. That way, you can set up schedules that make sense and simply follow up on reports and expenses tracked.

Before you pick you accounts payable software for small business

Of course, choosing what software works better for you doesn’t stop at features. Some other concerns are the cost, the fit within your workflow and the connectivity to other essential tools. Here’s what you need to know.

Pricing and free trials

Cost can be a prohibitive aspect of implementing new accounts payable software for small business owners. However, they often work on different pricing scales you can take advantage of. Some tools offer lower-cost subscriptions for fewer users, which can help your smaller team thrive.

Another important point is testing the product before you commit to it. Most of them have free trials, spanning a couple of weeks, so that you can truly experience the user side. Others come with a freemium option, with limited tools, that you can upgrade as soon as you feel confident it’s the right option.

That way, the investment is better allocated to the right resource.

Integrations

Of course, part of automation in accounts payable requires your software to be compatible with your workflow. So if you use Google Workspace, for instance, you should look for a tool that meshes well with Google Apps.

Sometimes you need to integrate your tool to a specific task. For instance, sending payment receipts to your accountant or contractors. Then, you’d need your accounts payable software to integrate with your mass email software.

Take notice of what you require your apps to do and, before you pick one, make sure it aligns with your workflow management.

Privacy and data settings

Payments and accounts are sensitive data that needs extra caution. Security breaches can affect the company’s financial health, especially small businesses. So you need to make sure the tool you are using is safe, well-encrypted and takes significant measures against digital threats.

Another important aspect of this is paying attention to how your data is being used. Your accounts payable tool has to comply with GDPR standards and/or local laws regarding privacy and data use.

Banking features

Besides other integrations, you need to make sure your accounts payable software is compatible with your banking system. With global and remote work, companies, even small businesses, have to use different forms of payment.

And since your goal is to automate accounts payable, you should pick a tool that allows you to finish these tasks more efficiently. To be truly productive, they have to align with all banking systems you use regularly.

Turn Gmail into your Team’s Workspace.

- 2.5x faster email responses.

- 20 hours less spent per month, per team member.

- 40% more deadlines achieved and happier teams.

Top 5 accounts payable software for small business

Now that you know the most significant aspects of choosing an accounts payable software for small business, here are the top options to explore. Browse through their features, pricing and ratings to pick the one that works for you.

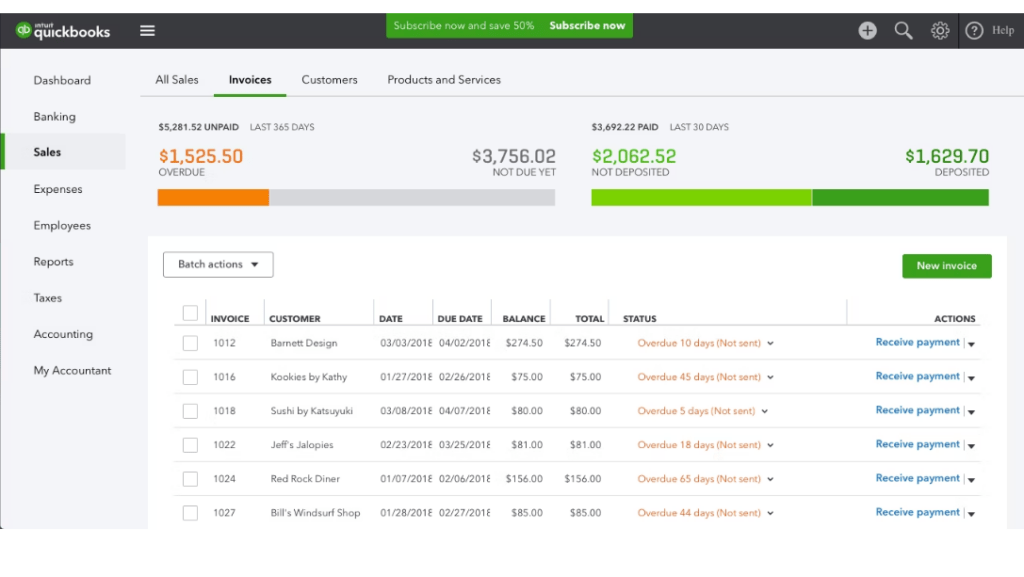

Quickbooks online

Quickbooks online is a fast, web-based solution for accounts payable software for small business. It offers a full suite of accounting tools, such as managing your cash flow and creating estimates . It can be used to organize accounts payable and receivables, so you can send your clients invoices with different payment options and track their completion, all in one app.

Quickbooks online is a fast, web-based solution for accounts payable software for small business. It offers a full suite of accounting tools, such as managing your cash flow and creating estimates . It can be used to organize accounts payable and receivables, so you can send your clients invoices with different payment options and track their completion, all in one app.

Capterra review: 4.3 stars

Pricing: $30/month (with a 30-day free trial)

Key features:

- Tax preparation

- Receipts collecting

- Duplicate payment alert

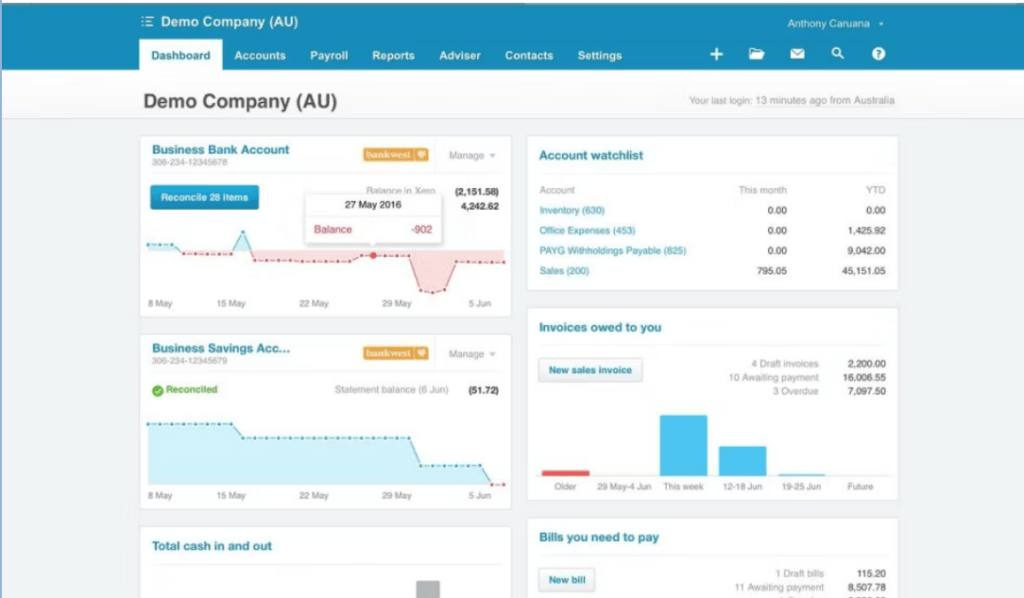

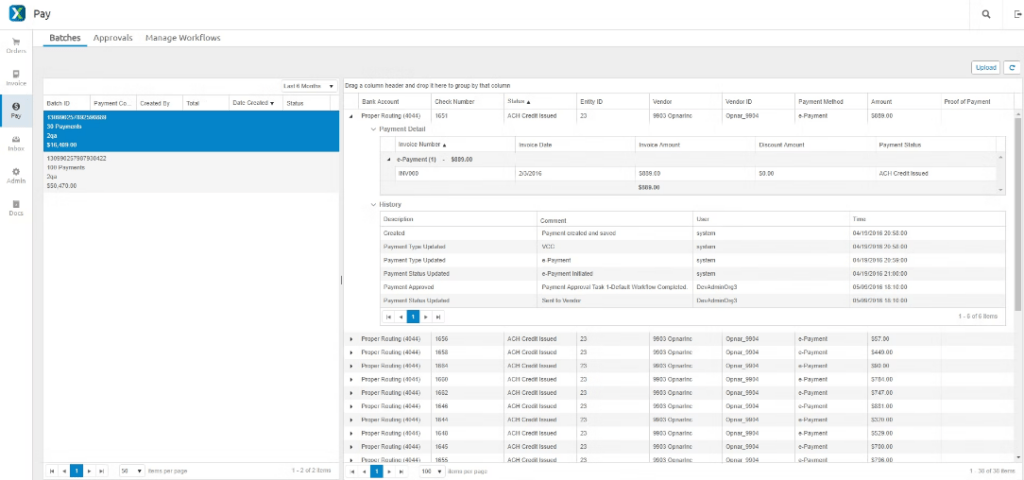

Xero

Xereo was developed to help companies of any size stay on top of their resource management and bills. Part of what makes this app unique is that it works on an email basis: you can send your bills directly to a defined address and it goes straight into the platform. That way, managers and team members can easily work from within their own inbox.

Capterra reviews: 4.4 stars

Pricing: starts at $13/month for the limited plan

Key features:

- Business snapshot

- Multiple currencies

- Bank reconciling in bulk

- Expense reimbursements

Freshbooks

Freshbook’s user experience is designed to attend to independent contractors and freelance professionals. It works great as an accounts payable software for small business because it offers all parts of billing and payments in one space. That means it’s great for freelancers who need a one-stop platform for all their accounting needs.

Capterra reviews: 4.5 stars

Pricing: $17/month with a 30-day trial

Key features:

- Automatic expenses

- E-signatures and business proposals

- Accountant access

AvidPay

With AvidXchange’s solution, you can easily monitor your incoming payments and make sure you can fulfill them on time. It helps business build a better relationship with their vendors and contractors, with personalized workflows and automation.

Capterra review: 4.6 stars

Pricing: quote upon request

Key features:

- Vendor network

- Instant payment confirmation

- Audit trail

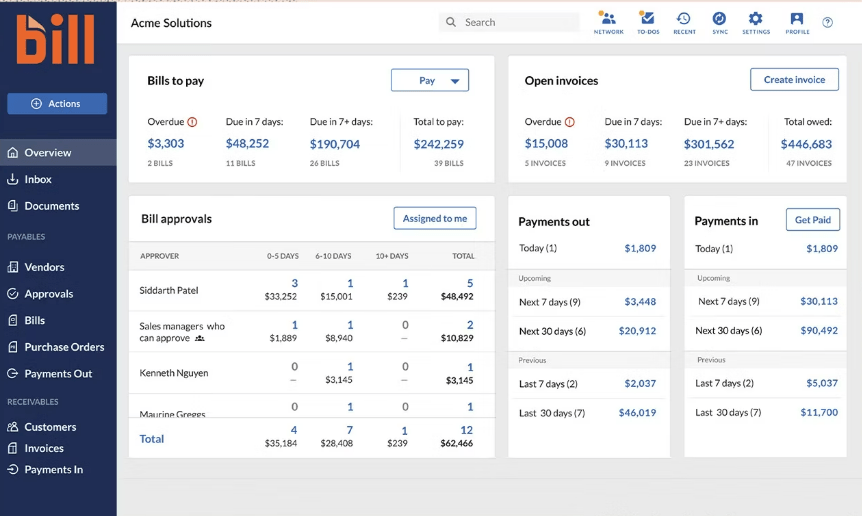

BILL

BILL describes itself as an all-in-one platform that helps small businesses thrive with automated accounting. The idea behind it is streamlining your accounts payable tasks with automated payments and reports that allow you to dedicate more time to other tasks.

But to make these automations happen, you can customize your process. For example, if the manager has to accept a specific payment amount, the platform directs it to them automatically. That way, you don’t have to manually go through every step, but you still have payment security.

The app includes billing, cash and vendor management and invoice generation as well.

Capterra reviews:

Pricing: 4.2 stars

Pricing: $45/user/month

Key features:

- Fraud detection

- ACH, virtual card, credit card and more payment options

- Custom approval routes

- Personalized user roles

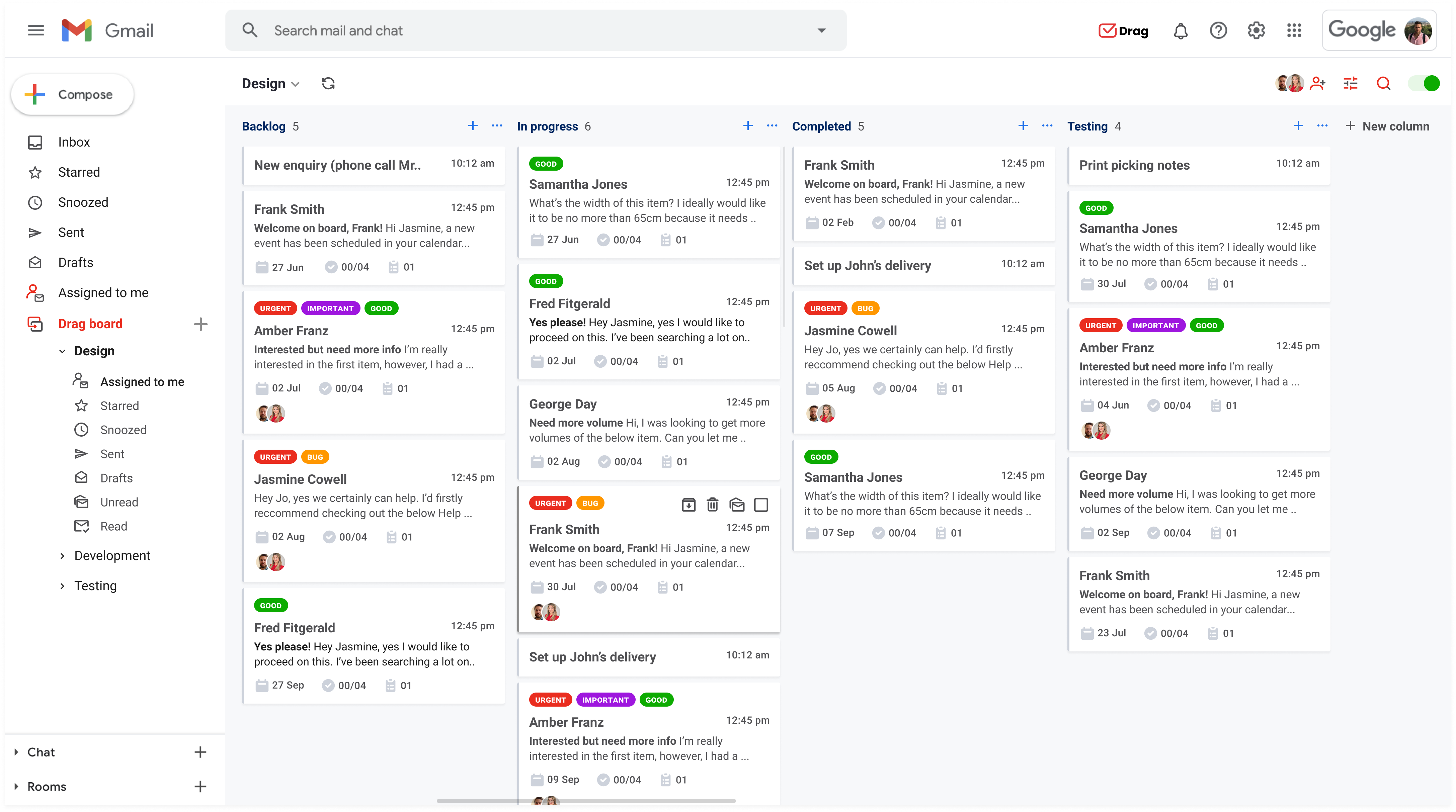

Automation in accounts payable and shared inboxes

Besides setting up all your impending payments in one place, accounts payable software is responsible for managing your cash flow and business estimates. That means choosing a program that includes automation in accounts payable can make it much easier.

For instance, some of them instantly detect incoming messages with bills, others can export payment confirmation to the right recipients. But it’s important to feed this information correctly to the platform. And when your team grows, more than one person can end up responsible for these tasks.

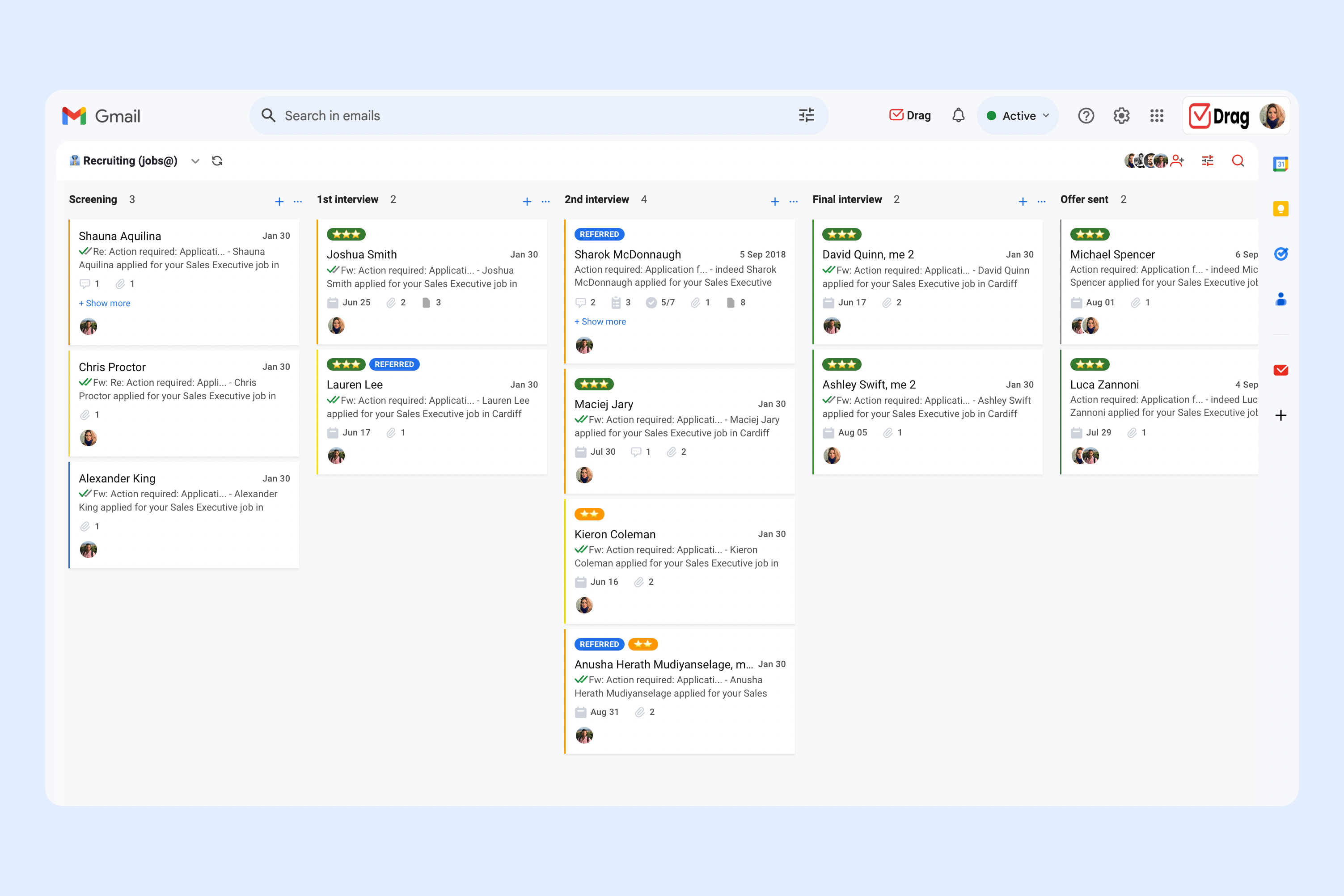

That’s when a shared inbox tool like DragApp can enhance the automation in accounts payable. The best part? It lives in Gmail, where most of your workflows start and end.

A shared inbox is a collaborative workspace built into a collective inbox. For example, your accounts payable department. Say all your vendors email you at [email protected]. Instead of each team member having to log out of their own account and into this email to export the bills, they can access the shared inbox from their own logins.

One advantage of a shared inbox is that it is synched with all members in real-time. In accounts payable, that is even more crucial. For example, say you get a bill from a contractor. If you send it to the spreadsheet and don’t mark it as read, another user from your finance team might log in and export it again. That could cause duplicate payments. Instead, with a shared inbox, users have accountability and see the same digital workspace, allowing everyone to follow what is being done by whom.

Used by thousands of finance teams, Drag’s shared inbox can be a much-needed ally to automation in accounts payable.

Wrapping up

Automation in accounts payable can be a helpful way to make your regular finance tasks smoother and more streamlined. You can set up custom workflows, organize your process and even develop a better relationship with vendors and contractors. That way, you can leverage these good habits into building a better company with a solid reputation, financial health and good future insights.

To do it, you need to pick the ideal accounts payable software that aligns with your small business and the tools that can add to it. In the future, these decisions can help you scale your company and become more profitable short and long-term.

Turn Gmail into your Team’s Workspace.

- 2.5x faster email responses.

- 20 hours less spent per month, per team member.

- 40% more deadlines achieved and happier teams.